June 16, 2009

by Amy Hoak

A federal tax credit of up to $8,000 is nudging many Americans into buying a home for the first time -- good news for those trying to sell one.

Still, selling a home isn't easy in most markets today. To get the typical first-time buyer to bite and submit an offer, a house has to stand apart from the competition -- and there's a lot of it, including foreclosure homes that are selling at hefty discounts.

One big thing working in favor of the traditional seller: A lived-in, maintained home is easier for buyers to imagine themselves living in than a vacant foreclosure. That has great appeal for someone buying a home for the first time, for practical and financial reasons.

"First-time buyers are skeptical of buying homes that need improvement. Sellers certainly don't need to remodel the kitchen, but they want to make sure that their home showcases very well," said Eric Mangan, a spokesman for ForSaleByOwner.com.

In fact, while nearly half of brokers polled for a Coldwell Banker survey last year found that affordability was the No. 1 concern for first-time buyers, 81% said move-in conditions were very important to these buyers. Only 7% said first-time buyers were looking to purchase fixer-upper homes that they could buy on the cheap and renovate.

Those feelings are likely just as strong today as lenders generally require larger down payments, unless the mortgage is backed by the Federal Housing Administration. Higher down payments means buyers have less cash left over for improvements, said Leslee MacKenzie, of Coldwell Banker Hickok & Boardman Realty in Burlington, Vt.

"They're doing what they can to save for the down payment," she said, and that will deplete some of the funds a home buyer would have for repairs. "They're concerned about out-of-pocket expenses upon taking ownership."

While foreclosures that are in severe disrepair can be a huge turnoff for a first-time buyer, some banks will make improvements to their foreclosure stock, fixing them up so that they meet FHA standards and a buyer's needs, said Chuck Whitehead, of Coldwell Banker Associated Brokers in Southern California. These homes can be stiff competition for the rest of the for-sale inventory.

Never fear; there are still ways to outshine other homes on the market. Assuming you've priced the home correctly, here are five ways to lure a first-time buyer:

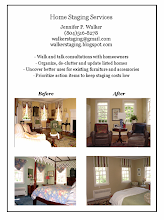

1. Maintain and stage.

A home that has been taken care of throughout the years will offer a stark contrast to a vacant, empty foreclosure. "If someone is living there, the landscaping is not dead," Mr. Whitehead said. "There is warmth in the home," and that can go a long way in selling a property. "It's all about the emotion, of having the ability to see what they can have."

As with any home, a fresh coat of paint, decluttering and the removal of unpleasant odors can go a long way to making a good first impression. But be careful not to over-improve the home, because the investment might not be worth the cost.

2. Mention that you'll help pay closing costs.

Whether it's in the marketing material or in the listing, this could be an extra motivator to reel in a buyer. Generally, there's a good chance they'll ask for closing cost help anyway, but it might pay off to be proactive and offer it at the beginning, said Heather Joubran, a real-estate agent with Re/Max Central Realty in Lake Mary, Fla.

If rising mortgage rates have your buyer spooked, consider paying mortgage points to bring the rate down, Mr. Mangan said. But consider a buyer's timeline for staying in the home before deciding if this is the most effective way to help; paying points generally makes sense for those staying in a home for more than a few years.

3. Offer a home warranty.

First-time buyers are often coming from a rental, and they are used to calling a landlord when there's a problem. To help them more easily transition into homeownership, provide them a warranty that covers major systems when problems arise, Ms. Joubran said.

4. Offer a buyer mortgage protection.

In some cases, it might make sense to address buyers' fears by purchasing insurance so they can keep up with their mortgage even if after losing a job. Coldwell Banker has such a program through its parent company, Realogy.

Basically, the plan will make several months of mortgage payments in the event that the buyer becomes unemployed. "There are people with secure jobs who are still nervous. This can give them just a little more comfort," Ms. MacKenzie said.

5. Don't snub low offers.

Buyers know prices have fallen, so they're being aggressive in their offers -- sometimes extremely aggressive. But even if they come in with a shocking lowball offer, don't scoff at it.

"My rule of thumb is every offer deserves a counteroffer," Ms. Joubran said. "At least counter them back. It gets the conversation going."

Write to Amy Hoak at amy.hoak@dowjones.com

http://online.wsj.com/article/SB124510978756816993.html